We will provide a sample of filling out 4-FSS for the 3rd quarter of 2017, and we will also comment on the procedure for filling out the report. What rules should you follow when filling out Table 2 of the 4-FSS report? How, according to the instructions, to reflect reimbursement of expenses from the Social Insurance Fund in the calculation for the 3rd quarter? Is it possible to fill out 4-FSS online for free? What is the deadline to submit 4-FSS for the 3rd quarter? Is it really necessary to take 4-FSS using the new form? Here are detailed instructions for filling out 4-FSS for accident insurance premiums. You can also download a new report form.

What contributions does the FSS control since 2017?

Since 2017, divisions of the Social Insurance Fund (SIF) have kept under their control:

- insurance premiums for insurance against industrial accidents and occupational diseases (that is, “injury” contributions);

- expenses of policyholders for social insurance purposes.

Therefore, insurance premiums “for injuries” accrued from January to September 2017 must be reported to the territorial office of the Social Insurance Fund and a report for the 3rd quarter of 2017 must be submitted to the Social Insurance Fund.

Who must submit the report for the 3rd quarter

All insurers are required to submit a calculation in accordance with Form 4-FSS for the 3rd quarter of 2017: organizations and individual entrepreneurs paying individuals remuneration subject to contributions “for injuries” (clause 1 of Article 24 of the Law of July 24, 1998 No. 125-FZ).

Individual entrepreneurs without employees who pay insurance premiums only “for themselves.” Individual entrepreneurs without employees do not need to submit 4-FSS for the 3rd quarter of 2017.

If, for some reason, from January 1 to September 30, 2017, the organization did not make payments that are recognized as subject to insurance contributions to the Social Insurance Fund, and does not pay these contributions, then, despite this, submit a zero 4-FSS report for the 3rd quarter 2017 is necessary.

Even if the organization did not conduct any activity during the reporting period, the “zero” calculation still needs to be submitted. There are no exceptions for such cases in the current legislation. In the “zero” calculation using Form 4-FSS, fill out only the title page and tables 1, 2, 5.

Deadlines for submitting 4-FSS for the 3rd quarter

Policyholders submit calculation 4 - FSS to the territorial body of the FSS of the Russian Federation at the place of their registration within the following deadlines:

- no later than the 25th day of the month following the reporting period, if reporting is sent electronically;

- no later than the 20th day of the month following the reporting period, if 4-FSS is submitted “on paper”.

Reporting periods

There are 4 reporting periods in total:

- I quarter;

- half year;

- nine month;

Thus, the deadline for submitting 4-FSS for the 3rd quarter of 2017 is no later than October 20 “on paper” and no later than October 25 – in electronic form.

How to prepare for passing 4-FSS

In electronic form, the calculation can be submitted to the FSS division of Russia:

- via telecommunication channels (via the 4-FSS payment gateway on the Internet);

- on external media (floppy disk, CD, flash drive, etc.) with an electronic signature.

To prepare 4-FSS online in electronic form, you can use the electronic portal of the FSS of Russia. On this Internet portal you can fill out 4-FSS electronically for free and submit it to Social Security.

Today, on the portal for preparing and submitting electronic reporting 4-FSS online, you can use:

You can also fill out and submit the 4-FSS for the 3rd quarter of 2017 using programs and online services provided by electronic document management operators. See “EDO operators: list”.

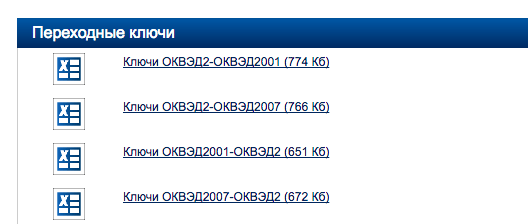

To successfully pass 4-FSS for the 3rd quarter of 2017, employers need to replace the old key certificate for reporting to the FSS with a new one. As of September 15, 2017, a new signature verification key certificate is in effect. The key certificate needs to be updated for those who submit the electronic 4-FSS, as well as for employers from the regions participating in the FSS pilot project, who send electronic registers of information to the Fund for the assignment and payment of benefits.

If you do not install new certificates, the program will not allow you to send anything to the fund. A message appears indicating an error or inability to decrypt the document. Download the latest keys on the website fss.ru in the “Certification Authority” section. You need a public key certificate to sign the receipt. The file is called F4_FSS_RF_2017_qualified.cer. Its validity period is one year starting from September 15, 2017. Then the certificate will need to be changed again. Update the keys in the work program through which you send reports. If you use free foundation programs for this, follow the instructions. There is a link to it in the same section of the site where the certificates are: “Recommendations for submitting payslips according to Form 4-FSS of the Russian Federation.” Do not delay renewing your certificates until you submit 4-FSS. In October, during the reporting campaign for submitting 4-FSS for the 3rd quarter of 2017, overloads may occur on the FSS website. And then it will become difficult to download files.

Please note that since September 15, 2017, amendments have also been made to the technology for accepting electronic payments. The changes concern the structure and format-logical relationships of 4-FSS when submitting calculations electronically with electronic signatures starting from the 3rd quarter of 2017.

New 4-FSS form for the 3rd quarter of 2017: what has changed

Since 2017, the 4-FSS form has been used, approved by Order of the FSS of Russia dated September 26, 2016 No. 381. The 4-FSS report form includes the following tables (mandatory and additional):

| Required sheet and tables | Additional tables |

| Title page | Table 1.1 “Information required for calculating insurance premiums by policyholders indicated...” |

| Table 1 “Calculation of the base for calculating insurance premiums” | Table 3 “Expenditures on compulsory social insurance against accidents at work and occupational diseases” |

| Table 2 “Calculations for compulsory social insurance against accidents at work and occupational diseases” | Table 4 “Number of victims (insured) in connection with insured events in the reporting period” |

| Table 5 “Information on the results of the special assessment of working conditions...” |

In June 2107, the FSS changed the form of the report on accrued and paid insurance premiums “for injuries” (4-FSS). The amendments were made by FSS Order No. 275 dated 06/07/2017. The updated calculation form came into force on 07/09/2017. Let us explain what has changed in the form.

Since July 9, 2017, a new field has appeared on the title page of 4-FSS that needs to be filled out by budget organizations. Also, Table 2 “Calculations for compulsory social insurance against accidents at work and occupational diseases” has been supplemented with two new lines:

- 1.1 “Debt due to a reorganized policyholder and/or a separate division of the organization deregistered”;

- 14.1 “Debt from the territorial body of the Fund to the policyholder and/or to a separate division of a legal entity that has been deregistered.”

In addition, in order to fill out the 4-FSS calculation, it is now clarified that in the “Average number of employees” field on the title page of the calculation, the indicator is calculated for the period from the beginning of the year. Before this there was no direct indication of this.

The FSS provided an explanation on its website that Order No. 275 dated 06/07/2017 came into force on the date after the start of the reporting campaign for the 2nd quarter of 2017. Therefore, it must be applied from reporting for the 3rd quarter of 2017.

New form 4-FSS for reporting for the 3rd quarter of 2017 in Excel format. This is the latest version of the form.

Where to submit reports

If the organization does not have separate divisions, then 4-FSS for the 3rd quarter of 2017 must be submitted to the territorial branch of the FSS of Russia at the place of registration of the company (Clause 1, Article 24 of the Federal Law of July 24, 1998 No. 125-FZ).

If there are separate divisions, then Form 4-FSS for the 3rd quarter of 2017 must be submitted to the location of the separate division. But only on the condition that the “isolation” has its own current (personal) bank account and it independently pays salaries to employees.

Order and sequence of filling

What sheets should be filled out as part of 4-FSS? This question worries many. We answer: in the calculation of 4-FSS for the 3rd quarter of 2017, it is necessary to fill out the Title page and tables 1, 2, 5. You also need to fill out (clause 2 of the Procedure for filling out calculation 4 - FSS):

- table 1.1 - if in January - September you temporarily sent employees to another organization or to an individual entrepreneur under a staff provision agreement;

- table 3 - if in January – September insurance coverage was paid to individuals (for example, temporary disability benefits due to an industrial accident);

- Table 4 - if there were industrial accidents in January - September.

Examples and samples of filling

How to fill out the new 4-FSS form? What tables should be included in the calculation? Let's look at a specific example of filling. We hope that the Instructions for filling out 4-FSS will allow you to transfer your data to a similar calculation of 4-FSS.

Example.

The limited liability company "PROMO-S" (LLC "Promo-S") employs three people (including the founding director) with whom employment contracts have been concluded. One of the employees is disabled group III. All employees are citizens of the Russian Federation. During 2017, their number did not change.

For the 3rd quarter of 2017, employees of Promo-S LLC received the following payments, subject to accident insurance contributions (“injury insurance”):

| Period | Taxable payments accrued to employees (rub. kopecks) | ||

| excluding payments in favor of a working disabled person | payments to a working disabled person | total including payments to a working disabled person | |

| I quarter 2017 | 210000 | 105000 | 315000 |

| II quarter 2017 | 210000 | 105000 | 315000 |

| July | 70000 | 35000 | 105000 |

| August | 70000 | 35000 | 105000 |

| September | 70000 | 35000 | 105000 |

| Total for the 3rd quarter of 2017 | 630000 | 315000 | 945000 |

Promos-S LLC applies a tariff for accident insurance premiums of 0.40%. Discounts and surcharges to the insurance tariff applied by Promo-S LLC have not been established. For payments to a disabled employee, the organization applies a tariff of 0.24%. The amounts accrued by Promo-S LLC for the 3rd quarter of 2017 for accident insurance premiums were:

At the beginning of 2017, neither the organization had any debt to the FSS of the Russian Federation, nor did the division of the FSS of the Russian Federation have any debt to the organization.

At the end of the 3rd quarter of 2017, the organization incurred a debt in the amount of 364.00 rubles. These are insurance premiums accrued for September 2017, the payment deadline for which is in October 2017.

A special assessment of working conditions was carried out in 2016. The organization did not identify workplaces with harmful and (or) dangerous working conditions. In 2017, there were no industrial accidents in the organization.

Title page

The title page must be filled out in accordance with the rules of Section II of the Procedure for filling out calculations 4 - FSS. In the “Subordination Code” field, you must indicate the five-digit code assigned to the policyholder, in which:

- the first four digits mean the code of the territorial body of the Federal Social Insurance Fund of the Russian Federation in which the policyholder is registered;

- the fifth digit indicates the reason for registering as an insured.

Number on title page

On the title page, indicate (clause 5.15 of the Procedure for filling out 4-FSS):

- in the “Average number of employees” field – the average number of employees for the 3rd quarter of 2017, calculated in the usual manner;

- in the field “Number of working disabled people” – the list number of disabled people as of September 30, 2017;

- in the field “Number of employees engaged in work with harmful and (or) hazardous production factors” - the list number of employees in hazardous work as of September 30, 2017.

Table 1: calculation of the base for insurance premiums

In Table 1 of the 4-FSS report for the 3rd quarter of 2017 you need to:

- calculate the base for calculating contributions for accident insurance on an accrual basis from the beginning of the billing period and for each of the last three months of the reporting period;

- determine the size of the insurance rate taking into account the discount or surcharge.

When to fill out table 1.1

Table 1.1 as part of the 4-FSS form for the 3rd quarter of 2017 should be compiled exclusively by those insured employers who temporarily transfer their employees to other organizations or entrepreneurs. If so, then the table needs to reflect:

- number of assigned workers;

- payments from which insurance premiums are calculated for half a year, for April, May and June;

- payments in favor of disabled people;

- the insurance premium rate of the receiving party.

In our example, there is no need to fill out this table, since there were no such circumstances in the reporting period.

Table 2: Contribution calculations

In table 2 of the 4-FSS report for the 3rd quarter of 2017, you need to reflect the following information according to accounting data (section III of the Procedure for filling out calculation 4 - FSS):

- in line 1 – debt on accident insurance contributions at the beginning of 2017;

- in lines 2 and 16 – amounts of contributions accrued since the beginning of 2017 and paid for accident insurance (“injury insurance”);

- in line 12 – the debt of the territorial body of the FSS of the Russian Federation to the organization at the beginning of 2017;

- in line 15 – accident insurance expenses incurred since the beginning of 2017;

- in line 19 – arrears in accident insurance contributions as of September 30, 2017, including arrears in line 20;

- in other lines - the remaining available data.

Please note that by Order of the FSS dated 06/07/2017 No. 275, the following were added to Table 2 of Form 4 - FSS:

- line 1.1, which reflects the amount of debt of the reorganized insurer and (or) the deregistered separate division to the territorial body of the Federal Social Insurance Fund of the Russian Federation;

- line 14.1, which indicates information about the debt of the territorial body of the FSS of the Russian Federation to the reorganized policyholder and (or) to the deregistered separate division.

These lines are filled in by insurers-successors and organizations that included such separate divisions.

When to fill out table 4

Submit Table 4 as part of the 4-FSS report for the 2nd quarter of 2017, if from January to June there were industrial accidents or occupational diseases were identified. However, in our example, this table does not need to be filled out.

Table 5: Special assessment and physical examinations

Table 5 of the 4-FSS report for the 3rd quarter of 2017 must reflect the following information:

- on the total number of workplaces subject to a special assessment of working conditions, and on the results of the special assessment, and if the validity period of the certification results of workplaces has not expired, then information based on this certification;

- on mandatory preliminary and periodic medical examinations of employees.

Liability: what threatens policyholders

For violation of the deadline for submitting calculations 4 - FSS for the 3rd quarter of 2017, a fine is established: 5% of the amount of accident insurance contributions accrued for payment for July, August and September for each full or partial month of delay. In this case, the fine cannot be less than 1,000 rubles and should not exceed 30% of the specified amount of contributions (Clause 1, Article 26.30 of Law No. 125-FZ).

Also, the company employee responsible for reporting (accountant or director) can be fined in the amount of 300 to 500 rubles (Part 2 of Article 15.33 of the Code of Administrative Offenses of the Russian Federation).

How does compensation from the Social Insurance Fund work in 2017?

Despite the fact that from 2017 the tax authorities will control the payment of insurance premiums, the Social Insurance Fund will continue to check the costs of paying benefits and allocate funds to reimburse such costs.

For reimbursement of the costs of paying benefits, the employer applies to the FSS office in cases where accrued insurance contributions are not enough to pay benefits or the employer applies a reduced “zero” tariff and does not pay compulsory social insurance contributions, for example, payers on the simplified tax system (simplified taxation system), carrying out preferential activities (Part 2, Article 4.6 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”).

Due to the fact that the new form 4-FSS does not contain information on accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and expenses incurred, to reimburse expenses for benefits paid after January 1, 2017, you will need additionally submit a calculation certificate, which must include all the data specified in clause 2 of Order No. 585n. In particular, information about arrears in contributions at the beginning and end of the reporting (calculation) period, about accrued contributions, additionally accrued and paid contributions, about expenses that were not accepted for offset. Such information is provided on the FSS website.

Changes in tax legislation, which came into force at the beginning of 2017, led to the fact that the administration of almost all mandatory payments to extra-budgetary funds was assigned to tax authorities. The only exception was contributions for compulsory insurance against accidents at work, in common parlance for injuries. They are still completely handled by social insurance.

Changes in reporting provided

The major change in revenue administrators led naturally to a change in reporting forms, thanks to desk audits of which the discipline in paying contributions is assessed. Previously, reports were submitted:

- to the Pension Fund - for contributions to compulsory pension insurance and compulsory health insurance;

- to the Social Insurance Fund - for contributions to insurance for cases of temporary disability (for sick leave payments) and for contributions for injuries.

Now the tax authorities have developed their own form, convenient for them, regarding contributions to compulsory health insurance, the Federal Compulsory Medical Insurance Fund and the Social Insurance Fund in terms of contributions for temporary disability. Accordingly, social insurance excluded everything related to sick leave from the old 4-FSS report and left only what was related to injuries. Reports on disability contributions are now one of the sections of the corresponding calculation for the tax office. Thus, a new form 4-FSS appeared.

Providing 4-FSS: dates and method of data transfer

Form 4-FSS is still provided by all organizations where, in accordance with the concluded agreement, employees work for wages. This applies equally to both public and private organizations, and individual entrepreneurs. The latter, if they do not have employees, pay these contributions at will and do not submit Form 4-FSS. No corresponding notification to the fund is required.

Form 4-FSS can be filled out and submitted to the fund department where the organization is registered, both in paper and electronic form. That is, the transfer is carried out both by direct presentation and through electronic communication channels. Moreover, there is an interesting nuance: the transfer can be made both through special operators and directly through the official website of the FSS.

The reporting deadlines have not changed:

- in paper form - until the 20th day of the month following the reporting quarter;

- via electronic channels - until the 25th day of the month following the reporting quarter.

Sanctions for late reporting

If the completed 4-FSS form is not received by the social insurance department on the prescribed dates for any reason, then the sanctions established by law are applied to the debtor: administrative fines are imposed on him. Both the organization and the official (most often the manager) are fined. For an organization, the fine will be from 5 to 30 percent of the total accrual of contributions for the quarter for which data was not submitted on time (but not less than a thousand rubles), for a manager from three hundred to five hundred rubles, according to the decision of the magistrate.

How to fill out a report: innovations

A sample of filling out 4-FSS, in force since October 2017 (report submission period is nine months), is available on most accounting websites. Explanations for filling out are also available on the official website of the FSS.

It contains a number of changes:

- on the title page there is a field for data about the organization’s membership in a certain budget level;

- the indicator of the number of employees has been replaced by the average number of employees;

- in table 6, instead of columns, the indicators are divided into rows;

- in Table 2 there is no need to separately fill in information on benefits issued to foreigners from the EAEU.

4-FSS: sample filling

Under the new rules, all information related to disability insurance premiums has been excluded. Filling out 4-FSS is carried out only for sections related to injuries. It became half shorter.

- Each page must indicate the individual registration number found in the notice of registration as an insured that was assigned to the fund.

- Table 1 reflects the calculation base for contributions to insurance for injuries and occupational diseases. The amount of the tariff is related to the occupational risk class that is assigned to the organization in accordance with the norms of the current legislation in accordance with OKVED, recorded in the statutory documents of the enterprise. The class is usually indicated in the corresponding notification from the Social Insurance Fund, issued upon registration of a legal entity as a payer. There may be several classes, depending on the number of activities. If there is only one class, then filling out 4-FSS is done once. If there are divisions with different classes, then the calculation is filled out as many times as there are classes.

- Table 1.1 is presented only by those legal entities that transfer their employees to other organizations for a certain period of time.

- Table 3 is filled out if you made payments for sick leave issued due to work-related injuries or occupational diseases, or spent money on injury prevention. The entire list of expenses can be found in Law 125-FZ. Costs for special assessments must be reflected in this section only if they were authorized by the fund. If the enterprise’s funds were not spent or expenses were carried out without the prior consent of the fund, then information about the expenses is not included in the report. For permission from the fund for a special assessment, which guarantees subsequent compensation for the costs incurred from social insurance funds, an application and the necessary package of documents are submitted to the fund before August 1. The application will be reviewed by the fund and a decision will be made on whether to allow or prohibit a special assessment for payment of contributions for injuries.

- Table 4 is filled out in case of accidents at work.

- Table 5 reflects the number of jobs that require special assessment.

Should I give up zero?

In the current work of organizations, there are situations when activities for some reason are not carried out or there are no employees. Accordingly, no contributions are calculated or paid from salary. But such cases do not exempt you from submitting reports. Zero calculations are presented according to general rules. Filling out form 4-FSS zero for a number of positions is absolutely no different from a regular report. The title and a number of tabular forms (1, 2, 5) must be filled out. The due dates for zero are the same.

What to do if errors are found

If you independently identify errors made when drawing up the 4-FSS report, you must correct them and notify the fund about the new indicators. But this rule only applies in cases where the calculated payment amounts were underestimated. In cases of overstatement, there is no obligation to notify the fund. All relationships can be adjusted when the next calculation is provided on an accrual basis.

In case of an underestimation, an adjustment is made to filling out the 4-FSS. A sample and explanations for the rules for drawing up adjustments can also be found on almost all resources on the Internet dedicated to accounting and on the official website of the Social Insurance Fund. The title must indicate that this is an updated calculation and indicate the adjustment number.

Important! When drawing up the clarification, exactly the report form that was in effect during the period when the calculation was submitted is used. That is, if errors are found in 2016, then the form of that year is used, taking into account all sections relating to sick leave. If errors were made specifically in the calculation of contributions for disability insurance for 2016 and earlier periods, then the updated calculation should be submitted to the fund, and not to the tax office.

What is not the basis for calculating contributions?

When drawing up the calculation, the responsible employee should remember that not all payments made to employees are subject to injury contributions. The corresponding exceptions in total terms must be reflected in Table 6 of the calculation. Contributions for injuries are not accrued for payments to foreigners temporarily staying in the territory of our state, and for the amount of disability benefits paid at the expense of the employer.

Important! When concluding a contract, insurance premiums for disability payments are not charged, but injury insurance may well be one of the sections of the contract. In such cases, contributions are paid and information about them is included in the calculation.

Conclusion

Summarizing all of the above, it should be noted:

- Samples of filling out 4-FSS from 2017 differ from the previous ones with the exception of sections relating to insurance contributions for sick leave, which are now administered exclusively by the tax office.

- The obligation to submit reports to the Social Insurance Fund remains, as well as the deadlines, forms and methods of submission.

What changes occurred in 4-FSS for 9 months of 2017

4-FSS - new form for the 3rd quarter of 2017

From 01/01/2017, all insurance premiums came under the jurisdiction of the tax authorities, except for social insurance contributions against work-related injuries and occupational diseases paid to the Social Insurance Fund. Contributions for “injuries” should still be reported to the Social Insurance Fund. In this article we will talk about the current 4-FSS form for the report for 9 months of 2017, which has recently changed again, and we will provide a sample of how to fill it out.

Form 4-FSS in 2017

If previously the 4-FSS report was intended for all insurance premiums paid to the Social Insurance Fund, then from the beginning of 2017 it reflects exclusively contributions for “injuries”. For the first quarter and half of 2017 Insurers reported using a modified Form 4-FSS, from which sections relating to insurance premiums in case of temporary disability and maternity were excluded.

Form 4-FSS 2017, the new form of which was approved by Order of the FSS of the Russian Federation dated September 26, 2016 No. 381, was used for reporting for the first quarter and half of the year. For a report for 9 months, it is filled out on a form with amendments made by order of the FSS of the Russian Federation dated 06/07/2017 No. 275.

New form 4-FSS: what has changed in the report for 9 months of 2017

There are few changes in the 4-FSS calculation form, all of them affected the title page and table 2:

- a field appeared on the title page intended for public sector employees - “Budgetary organization”, which indicates the code of the source of funding

- in table 2, which reflects settlements with the Social Insurance Fund, line 1.1 has been added about the debt transferred to the insured-successor from the reorganized legal entity, or the debt of a separate division deregistered

- Accordingly, in line 8 “Total” of the report form 4-FSS there is a new calculation formula - line indicator 1.1 has been added to it

- Line 14.1 has been added to Table 2, reflecting the debt of the Social Insurance Fund to a reorganized legal entity, or a separate division that has been deregistered

- in line 18 “Total” the formula has changed due to the inclusion of line 14.1 indicator in it

Corresponding additions have been made to the Procedure for filling out Form 4-FSS. New form for 2017 with changes from 06/07/2017. applies starting from the report for 9 months of 2017. Updated calculations of 4-FSS for periods earlier than 2017 are submitted on the form that was in force in the billing period for which the adjustment is made (clause 1.5 of Article 24 of Law No. 125- dated July 24, 1998 Federal Law).

Filling out 4-FSS

The procedure for filling out the 4-FSS calculation remains the same; it can be found in Appendix No. 2 to Order No. 381, as amended. dated 06/07/2017. If the policyholder is registered where the FSS pilot project operates, he needs to take into account the filling out features approved by Order of the FSS of the Russian Federation dated 03/28/2017 No. 114.

Let us recall the basic requirements of the instructions that should be observed when preparing the 4-FSS calculation (new form for the 3rd quarter of 2017):

- the form must be filled out on a computer or manually, but only in block letters and black or blue ink

- on each page the number of the policyholder in the Social Insurance Fund and the code of subordination are indicated, at the bottom of the page a signature and date are placed

- monetary indicators are not rounded - they are reflected in rubles and kopecks, instead of a zero value a dash is placed

- indicators are entered on a cumulative basis from the beginning of the year

- All pages of the form must be numbered and their number must be indicated, as well as application pages, on the title page

Which sections of the 4-FSS calculation must the policyholder submit for 9 months of 2017:

- the title page and tables 1, 2 and 5 are mandatory, they must be submitted, even if there were no accruals for “injuries” in the reporting period, that is, the reporting is “zero”

- tables 1.1, 3 and 4 are submitted only when they contain the corresponding indicators

You can download the new form 4-FSS 2017 below.

When to submit a calculation for “injuries”

If the policyholder had an average number of employees for whom deductions are made last year exceeded 25 people, he can submit the calculation only electronically. The deadline for submitting the electronic form 4-FSS is no later than the 25th day of the month following the reporting period. For failure to comply with the electronic reporting format, the policyholder faces a fine of 200 rubles.

With an average headcount of 25 or fewer people, the policyholder has the opportunity to report both electronically and on paper. But for submitting a “paper” calculation, a shorter deadline is set - the 20th day of the month following the reporting period.

Thus, for 9 months of 2017, the electronic form 4-FSS must be submitted no later than October 25, 2017, and the “paper” form - October 20, 2017.

4-FSS new form: sample filling

To show what the new 4-FSS form looks like when completed, we give an example of a calculation for “injuries” for 9 months of 2017.

New 4-fss sample page 1

New 4-fss sample page 2

New 4-fss sample page 3

New 4-fss sample page 4

What is the deadline to submit the 4-FSS calculation for the 4th quarter of 2016? Do you need to use a new payment form? Has the new format for calculating Form 4-FSS been approved? Is it really necessary to submit 4-FSS to the tax office starting from 2017? Should old or new OKVED codes be included in the calculation? Let's look at a specific example of filling out 4-FSS for 2016.

Deadline for 4-FSS

All organizations and individual entrepreneurs paying individuals remuneration subject to compulsory social insurance contributions must report in Form 4-FSS for the 4th quarter of 2016 (Clause 2, Part 9, Article 15 of Federal Law No. 212-FZ of July 24, 2009) .

You must report on Form 4-FSS for the 4th quarter of 2016 within the following deadlines:

- no later than January 25, 2017 (this is Wednesday) – in electronic form;

- no later than January 20, 2017 (this is Friday) - “on paper”.

Note that after the New Year holidays, as a general rule, people go to work on January 9, 2017 (this is Monday). Cm. " ". Thus, the accountant has 10 working days in January to fill out and submit paper reports. There is more time to generate an electronic 4-FSS for the 4th quarter of 2016 - 13 working days.

Form 4-FSS for the 4th quarter of 2016: new form?

You must report for the 4th quarter of 2016 using the form approved by Order No. 59 of the Federal Social Insurance Fund of Russia dated February 26, 2015. It was this form that was used when submitting the 4-FSS calculation for 9 months of 2016. Use it when submitting the annual 4-FSS calculation for 2016. Let us remind you that this form combines reporting:

- for contributions to compulsory social insurance in case of temporary disability and in connection with maternity;

- on contributions to compulsory social insurance against accidents at work and occupational diseases.

Please note that Order No. 381 of the Federal Social Insurance Fund of Russia dated September 26, 2016 approved a new form of calculation, 4-FSS. Cm. " ". However, you need to use the new form starting with reporting for the 1st quarter of 2017. For the first time, you must report using the new form no later than April 20 “on paper” and April 25, 2017 – in electronic form. Starting with reporting for the 1st quarter of 2017, 4-FSS will need to reflect only contributions “for injuries”. Download the new calculation form for free using the link "".

Where to submit: to the tax office or to the Social Insurance Fund?

Submit the calculation in form 4-FSS for the 4th quarter of 2016 to the FSS department. Tax inspectorates will not accept calculations for 2016. Moreover, the new 4-FSS calculation form, used for reporting for the 1st quarter of 2017, also needs to be submitted to the FSS, and not to the Federal Tax Service.

Zero 4-FSS: is it necessary to take it?

Moreover, if an organization did not make any payments to individuals in the period from January to December 2016, then it still needs to submit the annual 4-FSS calculation for 2016. This is explained by the fact that organizations are always policyholders. The status of “insurer” is assigned to legal entities almost immediately after state registration. Organizations always remain in this status, regardless of the nature and existence of contracts with employees. Accordingly, even if there were no payments to individuals in 2016, you must submit at least a zero calculation of 4-FSS for the 4th quarter of 2016. Only individual entrepreneurs without employees can not submit 4-FSS for 2016. They are not recognized as insurers. Therefore, they do not submit the 4-FSS zero calculation.

Procedure for filling out 4-FSS for the 4th quarter 4-FSS: examples

All policyholders in the 4-FSS for the 4th quarter of 2016 must fill out and submit to the FSS:

- title page;

- tables 1 and 3 of section I;

- tables 6, 7, 10 of section II.

All other tables of sections 1 and 2 of the 4-FSS calculation for the 4th quarter of 2016 must be filled out only if there are indicators that need to be reflected in these tables. If there is no data, then the tables are not filled out and are not submitted (clause 2 of the Procedure, approved by Order of the FSS of Russia dated February 26, 2015 No. 59, hereinafter referred to as the Procedure).

At the top of Form 4-FSS for the 4th quarter, on each page, indicate the registration number of the policyholder, subordination code and page number.

Filling out the title page

If an organization or individual entrepreneur submits 4-FSS for the 4th quarter for the first time, then in the “Adjustment number” field, show “000”. If in 2017 the previously submitted 4-FSS calculation for the previous period (for example, for six months or 9 months) is being clarified, then enter the serial number of the adjustment (“001” – being clarified for the first time, “002” – for the second time, etc.). d.).

In the “Reporting period” field, fill out the first two cells - indicate 12 in them. Thus, you will make it clear that you are submitting the annual calculation of 4-FSS for 2016. Place dashes in the next two cells. In the Calendar Year field, enter 2016. Also include the company name. The individual entrepreneur must indicate his last name, first name and patronymic.

Also, on the title page, indicate the TIN, KPP, OGRN and registration address. There are usually no problems filling out these details. But there are difficulties with the “Average number of employees” field. In this indicator, do not take into account women on maternity leave, as well as workers on parental leave for up to 1.5 years.

In the “of which women” field, show how many insured women the policyholder has in total. But do not include women on maternity leave in this indicator (clause 5.14 of the Procedure). Also see "". Here is a sample filling:

Completing section 1

In Section I of 4-FSS for the 4th quarter of 2016, you need to show the data necessary to calculate insurance premiums in case of temporary disability and in connection with maternity, as well as the amounts of sick leave, “children’s” benefits and other payments themselves. Let us explain some of the features of filling out the tables in this section as part of the annual calculation of 4-FSS for 2016.

OKVED code

At the beginning of Section I you need to reflect the OKVED code. In this case, the “OKVED Code” field is filled in only by insurers who in 2016 applied reduced premium rates in accordance with paragraphs 8 and 11 of part 1 of Article 58 of Federal Law No. 212-FZ of July 24, 2009. If contributions were paid at regular rates, then leave the OKVED field empty.

Note that the new OKVED codes were approved by Rosstandart by Order No. 14-st dated January 31, 2014. They have been used since 2017. In this regard, in the calculation of 4-FSS for the 1st quarter of 2017, it is necessary to indicate a new OKVED code according to the Classifier OK 029-2014. How the OKVED code of your company has changed, see on the website of the Ministry of Economic Development of Russia http://economy.gov.ru/ in the section “Activities - Directions - All-Russian classifiers assigned to the Ministry of Economic Development of Russia” http://economy.gov.ru/

However, when calculating 4-FSS for the 4th quarter of 2016, indicate the old codes in accordance with Classifier OK 029-2001.

Keep in mind that in Form 4-FSS for 2016, the accountant will encounter the “OKVED Code” field three times. However, not all code fields need to be filled out. To avoid errors in OKVED codes when filling out the report, pay attention to the table below. She will tell you which code to indicate in 4-FSS for 2016.

| Field in 4-FSS | Who fills out the “OKVED Code” | Which OKVED to apply |

| Section 1 before table 1 | Organizations on the simplified tax system applying reduced tariffs | Code according to OK 029-2001 for preferential type of activity |

| Section 2 before table 6 | All organizations | Code according to OK 029-2001 for the main type of activity based on revenue data for 2015 |

| Section 2 in column 4 of table 6.1 | Organizations that sent their employees to other companies under a personnel supply agreement | Code according to OK 029-2001 of the receiving party |

Who should apply the new OKVED

In the calculation of 4-FSS for 2016, provide the new OKVED codes according to the OK 029-2014 classifier, if the organization was registered after July 11, 2016. All other companies put down the old codes according to the OK 029-2001 classifier.

Table 1

Table 1 is a mandatory component of the 4-FSS for the 4th quarter of 2016. It must reflect information on accrued and paid insurance premiums and on settlements with the Social Insurance Fund of Russia as of January 1 and December 31, 2016.

For example, in line 1 of Table I, show the debt on insurance premiums that existed as of January 1, 2016. This indicator should be equal to the indicator in line 19 of Table 1 of the 4-FSS calculation for 2015. That is, just take this value from the 2015 annual calculation and transfer it to the current calculation.

In line 2 of Table 1 4-FSS for the 4th quarter of 2016, show the amounts of insurance premiums accrued for payment. Using the line “At the beginning of the reporting period” of 4-FSS for 2016, highlight the amount of accrued contributions for the quarters preceding the reporting period. That is, the amount of contributions accrued for 9 months (from January to September inclusive).

In column 3 of line 2, indicate the total amount of insurance premiums accrued for the entire 2016 (from January to December). This indicator will be equal to the sum of the indicators indicated in the lines “At the beginning of the reporting period” + “For the last three months of the reporting period.” That is, in the example below RUB 39,092. = (RUB 26,042 + RUB 13,050)

On line 15 of Table 1, indicate expenses for the purposes of compulsory social insurance from the beginning of 2016 to December 31 and separately highlight expenses for October, November and December. This indicator must correspond to the indicator in line 15 of Table 2 of Form 4-FSS (clause 7.13 of the Procedure). Let’s say that from January to December 2016 inclusive, the organization paid the employee sickness benefits once in December 2016 in the amount of 4,670 rubles. The accountant must fill out this amount in the annual calculation as follows:

On line 16 of Table 1 include contributions paid for the period from January to December 2016 inclusive. In this case, you must indicate the details of payment orders that were sent for payment in October, November and December 2016.

How to reflect December contributions

Show the accrued contributions for December 2016 in 4-FSS for the 4th quarter of 2016 in lines 2 of tables 1 and 7. And for the listed December contributions there is a peculiarity. If the organization paid contributions in December 2016, then fill out lines 16 of tables 1 and 7. And if in January 2017, then do not reflect them at all in 4-FSS for 2016. Cm. " ".

table 2

In Table 2 of Section I, fill in the benefits and payments accrued to employees from the Social Insurance Fund budget (in particular, sickness and maternity benefits). Reflect the benefit amounts together with personal income tax. Please keep in mind that sick leave benefits accrued by the employer at its own expense for the first three days of illness should not be included in Table 2. If, for example, one employee received sickness benefits from the Social Insurance Fund in the amount of 2,800 rubles, then this amount should be transferred to Table 2.

If benefits were not accrued from the Social Insurance Fund budget in the period from January to December, then do not fill out Table 2 as part of 4-FSS for the 4th quarter and do not submit it.

Table 3

Table 3 is a mandatory table as part of the calculation for the 4th quarter. Show in it the calculation of the base for calculating insurance premiums. In particular, reflect the total income of employees on an accrual basis from January to December 2016 inclusive, and also separately highlight the amount of payments that are not subject to contributions. For example, if non-taxable payments for the period from January to December 2016 amounted to 2,000 rubles, then fill in this amount in the table as follows:

Compare the total amount of payments for 2016 for each employee with the maximum base for insurance contributions to the Social Insurance Fund - 718,000 rubles. If there were more payments, then indicate the excess in line 3 of Table 3 of the annual 4-FSS.

Table 3.1

This table is intended for information about foreigners (except for the EAEU) temporarily staying in the Russian Federation (you need to provide personal information for each person, indicate his TIN, SNILS and citizenship). In the 4-FSS calculation table for the 4th quarter, you need to cumulatively summarize all foreigners whose payments from January to December 2016 were subject to insurance premiums (clause 11 of the Procedure).

Table 4

Table 4 is filled out only by companies operating in the field of IT technologies. The table provides data confirming the right to apply a reduced rate of insurance premiums (Part 3 of Article 58 of the Federal Law of July 24, 2009 No. 212-FZ).

Table 4.1

Table 4.1 is filled out by organizations or individual entrepreneurs on the simplified tax system, carrying out “preferential” types of activities in 2016, named in paragraph 8 of part 1 of article 58 of the Federal Law of July 24, 2009 No. 212-FZ. Fill out this table with a cumulative total. That is, show the amounts accumulated from January to December 2016 inclusive. This is stated in the table itself. As for filling, then:

- line 1 – show the total amount of income according to the simplified tax system;

- on line 2 - reflect income from the main activity according to the simplified tax system;

- on line 3 - highlight the share of income from the main activity according to the simplified tax system.

Table 4.2

Table 4.2 is filled out by non-profit organizations on the simplified tax system engaged in social services for the population, scientific research and development, education, healthcare, culture, art and mass sports.

Table 4.3

Table 4.3 is filled out, in general, by individual entrepreneurs on a patent. In the table, list information about issued patents, and also provide data on payments to employees since the beginning of 2016 and separately show payments for October, November and December 2016. However, some individual entrepreneurs do not need to fill out this table. This applies to those businessmen who:

- provide catering services;

- engage in retail trade through trading floors or retail locations;

- rent out real estate owned by them.

Table 5

Table 5 as part of the 4-FSS calculation for the 4th quarter of 2016 is intended for payments made from the federal budget. Please note: not at the expense of the Social Insurance Fund, but at the expense of the federal budget. Such payments include, for example, payments in excess of the established amounts of benefits to citizens affected by radiation (in case of accidents at the Chernobyl nuclear power plant, Mayak PA, Semipalatinsk test site, etc.).

Completing Section II

In Section II of Form 4-FSS, indicators are entered on the basis of which insurance premiums for “injuries” are calculated and the costs of paying insurance coverage are reflected. At the beginning of Section II, indicate the number of employed disabled people, as well as workers engaged in work with harmful and (or) hazardous production factors. Also indicate the OKVED code according to Classifier OK 029-2001 for the main type of activity based on revenue data for 2015.

Table 6

This table is called “Calculation of the base for calculating insurance premiums.” On line 1 of Table 6, indicate the total amount of payments subject to insurance premiums since the beginning of 2016, as well as separately for October, November and December 2016. Line 2 – payments that are not subject to insurance premiums. On line 3 – reflect the tax base. It is equal to the difference between the indicators of line 1 and line 2.

In column 3, provide the indicators calculated on an accrual basis from the beginning of the year (from January to December inclusive). And in columns 4–6 - indicators for the last three months of the reporting period (for October, November and December).

Table 6.1

This table as part of 4-FSS for 2016 needs to be filled out only by those who temporarily rent out their employees. Insurance premiums from payments to these employees are charged by the employer, and not by the one who hires the employees. If you don’t “rent” anyone, then don’t fill out the table.

Table 7

- line 1 – show the debt to the Federal Social Insurance Fund of Russia at the beginning of 2016 (if any). Even if it has already been repaid, it still needs to be reflected;

- line 2 – highlight the amount of accrued insurance premiums at the beginning of 2016 and separately for October, November and December 2016;

- line 8 – indicate the total amount. It is obtained by adding lines 1 to 7;

- line 16 – fill out the insurance premiums paid to the Social Insurance Fund, broken down for October, November and December 2016.

- line 18 indicate the total amount (lines 12 to 17, except 13 and 14).

- line 19 – debt as of December 31, 2016.

Table 9

Fill out Table 9 of Section II of Form 4-FSS if in 2016 the policyholder had industrial accidents or occupational diseases.

Table 10

Table 10 is mandatory in Form 4-FSS. All policyholders must fill it out. It is filled out on the basis (clauses 29.1, 29.2 of the Procedure):

- a report on a special assessment (certification) of working conditions carried out in the organization;

- medical records, reports and other documents issued based on the results of mandatory preliminary and periodic medical examinations of employees.

All data in Table 10 is as of January 1, 2016. Therefore, table 10 of the 4-FSS calculation for the 4th quarter of 2016 will be exactly the same as in the 4-FSS for the 9 months of 2016. But if the organization was registered in 2016, then put dashes in Table 10 (clause 2 of the Procedure).

4-FSS FOR Q4 in pilot regions

A pilot FSS project is being implemented in many regions (See "").

A pilot project is an experiment involving the payment of social benefits without the participation of employers. During the pilot project, there is direct financing of expenses for the prevention of injuries and occupational diseases from the budget of the Social Insurance Fund of Russia.

So, in general, fill out the 4-FSS calculation for the 4th quarter of 2016 in the regions participating in the pilot project according to the general rules. However, you need to take into account some subtleties. They are due to the fact that participants in the pilot project do not pay social benefits on their own and, accordingly, do not claim to have payments offset against contributions.

In Section I of Table 1, participants in the pilot project do not need to fill out line 15 (usually it shows information about expenses for compulsory social insurance). There is also no need to reflect any data in tables 2 and 5 of section I and table 8 of section II of form 4-FSS for the 4th quarter of 2016.

Also, some insurers do not know how to show in 4-FSS payment for additional days off when the employee was caring for a disabled child? In the “pilot” 4-FSS for the 4th quarter, do not show such amounts at all. In such a situation, the policyholder simply needs to pay for additional days off and submit an application for reimbursement of expenses to the FSS of Russia.

The deadline for submitting a report to the Social Insurance Fund in Form 4-FSS for the 1st quarter of 2016 is approaching. We have prepared detailed instructions for filling out this calculation form, taking into account all changes and amendments.

Calculation in form 4-FSS must be submitted to their territorial body by all organizations and entrepreneurs that have employees. The deadline for submitting this report is until the 20th day of the month following the reporting quarter in paper form and until the 25th day in electronic format.

Form 4-fss latest edition 2016 was approved by order dated February 25, 2016 No. 54, which amended the order of the FSS of Russia dated February 26, 2015 No. 59. Therefore, when filling out the report, you must be guided by both documents, and it is best to download the new one from latest edition of the order. Let's take a closer look at the reporting form.

Report form

Form 4-fss for the 1st quarter of 2016 consists of a title page and tables that must be filled out only if certain indicators are included in the accounting. It is mandatory for all employers to fill out the title page and tables 1, 3, 6, 7 and 10. The remaining tables 2, 3.1, 4, 4.1, 4.2, 4.3, 5, 8, 9 need to be filled out only if data is available. Otherwise, these sheets simply do not need to be submitted to the territorial body of the FSS of Russia. According to the general requirement, only one indicator can be entered in one column or line; if there is no data, then a dash is entered. You can download the new 4-fss form in 2016 Here. In addition, the article provides the procedure for filling out 4 fss.

Download form 4-FSS in excel format

Filling out the title page

The new form 4 fss has a changed title page, compared to the previous version of the document. Policyholders must fill it out in its entirety, with the exception of the subsection “To be completed by an employee of the territorial body of the Fund.” In 4-FSS for the 1st quarter of 2016, you need to fill in only the first two cells in the “Reporting period (code)” field. However, if the employer applied to the Social Insurance Fund of the Russian Federation with an application to allocate funds to pay insurance coverage in favor of the employee, he must also fill out the last two cells in this field.

Sample of filling out the title page of Form 4 FSS for the 1st quarter of 2016

Since the reporting periods for social contributions are quarter, six months and nine months, in the calculation for the 1st quarter of 2016 it is necessary to enter code “03”. If the organization is in the process of liquidation, then in the “Cessation of activities” field it is necessary to enter the code “L”. Otherwise, you do not need to fill in this field. However, the “Full name” field must be filled in by all policyholders. It must indicate the name of the organization as stated in the constituent documents.

In addition, you should enter all the details of the organization (TIN, KPP, OGRN). In this case, you should pay attention to the fact that in the “TIN” field, all organizations must indicate “00” in the first 2 cells. Since 2016, in the fields for indicating the address in the new 4fss form, the “District” field has appeared. It needs to be indicated only if it is in the constituent documents of the organization.

Particular attention should be paid to the “Payer code” field. It must indicate the correct category of insurance premium payer, which can be found in the table from appendices No. 1-3 to the order of the FSS of Russia. Moreover, in the first 3 cells of the field the code from Appendix No. 1 is filled in, in the next two cells - from Appendix No. 2, and in the last cells - from Appendix No. 3. Errors may lead to the fact that the report will not be accepted by the regulatory authority.

In field 4 of the FSS, latest edition 2016 “Average number of employees,” you must indicate the number of all insured employees of the organization. However, this is not the listed number of employees at the time of compilation of the report, but the number calculated in accordance with the annual instructions of Rosstat. Please note that in the field intended for filling out the indicator “of which: “women””, you must also indicate the average number of women employed in the organization for the reporting period (calculated using the form).

After the entire report has been completed, its pages must be numbered and their number must be entered in the “Calculation submitted to” field.

Filling out table 1

In the “OKVED Code” field, it is necessary to indicate the policyholder’s code in accordance with the All-Russian Classifier of Economic Activities only if the organization submitting the calculation applies a reduced tariff in accordance with Article 58 of the Federal Law of July 24, 2009 No. 212-FZ insurance premiums.

In this table of the new Form 4 FSS from 2016, all mutual settlements with the FSS of Russia should be indicated. Including the amount of debt the organization has for insurance premiums as of January 1, 2016. To check this indicator, it must be compared with the data from line 19 of section 1 of the calculation for 2015. It does not change throughout the calendar year.

In this table of the new Form 4 FSS from 2016, all mutual settlements with the FSS of Russia should be indicated. Including the amount of debt the organization has for insurance premiums as of January 1, 2016. To check this indicator, it must be compared with the data from line 19 of section 1 of the calculation for 2015. It does not change throughout the calendar year.

It is imperative to indicate the amount of insurance premiums that were accrued in the reporting period and are subject to payment to the Fund. It is necessary to detail this amount by month - in the 1st quarter it will be January, February and March. As shown in the sample form 4 fss for the 1st quarter of 2016.

The amount of contributions additionally accrued to the organization by specialists of the Federal Social Insurance Fund of the Russian Federation based on the results of desk and on-site inspections should also be indicated in the column of the policyholder’s obligations. Provided that it was in the reporting period. Otherwise, you need to put a dash. In addition, the amount of additional accrued contributions for previous reporting periods and the amount of the organization’s expenses for social insurance, which was not accepted by social insurance for offset, are reflected.

In the sixth line of Table 1 of Form 4 of the Social Insurance Fund for the 1st quarter of 2016, we indicate the amount of money that the company received from the Social Insurance Fund of the Russian Federation and was used to pay social benefits to employees. The amount of funds returned to the organization from the Fund as overpaid is reflected separately. Line 8 shows the sum of lines 1-7, it is the control. The organization must reflect in the report the amount of all insurance premiums transferred to it. They must be detailed, indicating all the numbers and dates of the payments with which they were listed for three months of the quarter.

The Fund's debt to the policyholder at the end of the reporting period is reflected below. This means that in the calculation of Form 4FSS for the 1st quarter of 2016, you should indicate the amount of debt as of March 31, 2016. The amount of social insurance debt must also be reflected as of January 1, 2016. In this case, the verification lines will be lines 9-11 from Form 4 FSS 2015, the form of which can be downloaded for free on the official website of the FSS of the Russian Federation. The amount of arrears that social insurance wrote off from the organization is separately highlighted. Line 18 reflects the sum of indicators of lines 12, 15-17, for control. Below you should indicate the amount of the organization's debt to the fund at the end of the reporting period, that is, as of March 31, 2016.

The Fund's debt to the policyholder at the end of the reporting period is reflected below. This means that in the calculation of Form 4FSS for the 1st quarter of 2016, you should indicate the amount of debt as of March 31, 2016. The amount of social insurance debt must also be reflected as of January 1, 2016. In this case, the verification lines will be lines 9-11 from Form 4 FSS 2015, the form of which can be downloaded for free on the official website of the FSS of the Russian Federation. The amount of arrears that social insurance wrote off from the organization is separately highlighted. Line 18 reflects the sum of indicators of lines 12, 15-17, for control. Below you should indicate the amount of the organization's debt to the fund at the end of the reporting period, that is, as of March 31, 2016.

Filling out table 2

In this section of form 4 FSS for the 1st quarter of 2016, you must indicate all information about the organization’s expenses in the reporting period made for the purposes of compulsory social insurance. First, you should indicate the number of days paid to employees for being on sick leave, as well as the number of payments made for temporary disability of employees and the number of benefits paid.

In line 1 of Form 4 FSS for the 1st quarter of 2016, you should indicate the number of cases of temporary disability benefits and their amount, which was paid from the funds of the FSS of the Russian Federation. Expenses for paying benefits for sick leave for external part-time workers are reflected separately (data for foreign citizens and stateless persons in both cases are not subject to reflection in the calculation).

In line 1 of Form 4 FSS for the 1st quarter of 2016, you should indicate the number of cases of temporary disability benefits and their amount, which was paid from the funds of the FSS of the Russian Federation. Expenses for paying benefits for sick leave for external part-time workers are reflected separately (data for foreign citizens and stateless persons in both cases are not subject to reflection in the calculation).

Amounts of funds offset against insurance premiums that should have been transferred to the Fund are reflected on an accrual basis. In field 6, you should separately highlight information about social benefits for workers paid by the federal budget. Line 16 must reflect the amount of benefits that were accrued but not paid to insured citizens. As a rule, these are benefit amounts for the last calendar month of the quarter. In the 4 fss new form 2016 this is March 2016. Please note that you need to indicate only those benefits for which the payment deadline has not been missed.

Filling out table 3

This section of Form 4 FSS for the 1st quarter of 2016 is intended to reflect the organization’s base subject to contributions for compulsory social insurance by virtue of social security legislation. Line 1 reflects the amount of payments that were accrued based on the income of all employees of the organization. Traditionally, detail is required by month of the reporting quarter. Next, payments in favor of employees who are not subject to insurance premiums are reflected. The next field (marked in the picture) is filled in only if in the reporting period there were payments that exceeded the maximum amount subject to social security contributions. In 2016, the limit of payments on the base in the FSS of Russia is 718 thousand rubles. The final line of the report 4 fss 2016 should indicate the actual payment base for calculating insurance premiums. It is calculated as the difference between lines 1-3. This information also requires detail.

- payments from pharmacy organizations;

- payments to crew members of sea and river vessels (with the exception of tankers intended for storing oil in seaports of the Russian Federation);

- payments to employees of individual entrepreneurs using the patent taxation system;

- payments made by Russian employers in favor of foreign citizens and stateless persons (with the exception of highly qualified specialists from the list of the Ministry of Labor and citizens of the EAEU member states).

Filling out table 5

Form 4 FSS 2016 contains data on such benefits as:

Form 4 FSS 2016 contains data on such benefits as:

- temporary disability benefits; pregnancy benefits;

- monthly child care allowance (with details for 1st, 2nd, 3rd and subsequent children);

- payment of additional days off to parents of disabled children; insurance premiums accrued to pay for such additional days off.

Employers must not only indicate all amounts, but also detail them by category of workers, highlighting the liquidators of accidents at the Chernobyl nuclear power plant, employees of the Mayak PA and the Semipalatinsk test site.

In 4fss, latest edition 2016, it is necessary to show the base, tariff rates and mutual settlements with the Fund for insurance premiums for injuries. All policyholders, without exception, must enter the OKVED code in this section. The tariff rate for insurance premiums for injuries and occupational diseases depends on the occupational risk class assigned to each employer. It depends on the type of economic activity of the organization, so employers who operate in several areas at once may have several occupational risk classes at once. All of them must be indicated in the calculation. Therefore, this section is filled out as many times as there are classes assigned to the employer.

The new Form 4 of the FSS should indicate the average number of disabled people working in the organization, as well as the number of employees who are employed in work with harmful or hazardous production factors.

The new Form 4 of the FSS should indicate the average number of disabled people working in the organization, as well as the number of employees who are employed in work with harmful or hazardous production factors.

Completing Table 6

The procedure for filling out 4 fss assumes that in this table you need to enter the amount of payments in favor of employees. They are reflected on an accrual basis from the beginning of the year. Each of the three months of the current reporting period is indicated separately. Next, you should indicate the amount of payments that are not subject to insurance premiums for injuries. Traditionally with detail. Line 3 indicates the difference between these two indicators, which will be the basis for calculating insurance premiums. In line 4, you need to highlight all payments made to disabled employees. The amount of the organization's insurance rate should be indicated in line 5. If you have the right to a discount, its percentage must be indicated. And the tariff surcharge, accordingly, is entered in line 7, the next field will indicate to the inspectors the date when this surcharge was set. The final tariff must be indicated with two decimal places.

The procedure for filling out 4 fss assumes that in this table you need to enter the amount of payments in favor of employees. They are reflected on an accrual basis from the beginning of the year. Each of the three months of the current reporting period is indicated separately. Next, you should indicate the amount of payments that are not subject to insurance premiums for injuries. Traditionally with detail. Line 3 indicates the difference between these two indicators, which will be the basis for calculating insurance premiums. In line 4, you need to highlight all payments made to disabled employees. The amount of the organization's insurance rate should be indicated in line 5. If you have the right to a discount, its percentage must be indicated. And the tariff surcharge, accordingly, is entered in line 7, the next field will indicate to the inspectors the date when this surcharge was set. The final tariff must be indicated with two decimal places.

Filling out table 10

In this section, it is necessary to indicate the fact of a special inspection of working conditions, the number of workplaces in fact and at the time of the inspection, as well as the class 3 or 4 assigned to the workplaces.

In this section, it is necessary to indicate the fact of a special inspection of working conditions, the number of workplaces in fact and at the time of the inspection, as well as the class 3 or 4 assigned to the workplaces.

Filling out table 4 form 4fss for the 1st quarter of 2016

Calculation 4 fss latest edition, a sample of which is given above, can be sent to the Social Insurance Fund in electronic form. The electronic format of Form 4 FSS can be downloaded for free on the official website of the Fund. You can also prepare a report on Form 4-FSS in accounting programs. The deadline for submitting calculations for the 1st quarter of 2016 in electronic form is April 25, 2016.

Calculation 4 fss latest edition, a sample of which is given above, can be sent to the Social Insurance Fund in electronic form. The electronic format of Form 4 FSS can be downloaded for free on the official website of the Fund. You can also prepare a report on Form 4-FSS in accounting programs. The deadline for submitting calculations for the 1st quarter of 2016 in electronic form is April 25, 2016.

This instruction will help you fill out the calculation of 4 Social Insurance Funds for the 1st quarter of 2016, taking into account all changes in legislation and social insurance recommendations. On the St. Petersburg legal portal you can always find the most current reporting forms and legal acts governing them.